Banking

Secure real banking users

SmartID’s solutions equip your banking company to offer seamless security in financial services.

Streamline onboarding processes and ensure compliance while unlocking new business possibilities.

Avoid common risks in digital banking platforms

Pishing

Identify user by common devices.

Identify if a device is being used to log into multiple accounts.

Hijacking / hacking

Cookie's theft

Multiple sessions through several channels

Malware

Web page modification

Compromised devices

Fraud is more sophisticated

Automatization of attacks

Identify user by common devices.

Identify if a device is beign used to log in into multiple accounts.

Diversified Phishing

Verify the validity of the details in the individual’s government-issued ID.

ID Verification

Verify the validity of the details in the individual’s government-issued ID.

ID Verification

Verify the validity of the details in the individual’s government-issued ID.

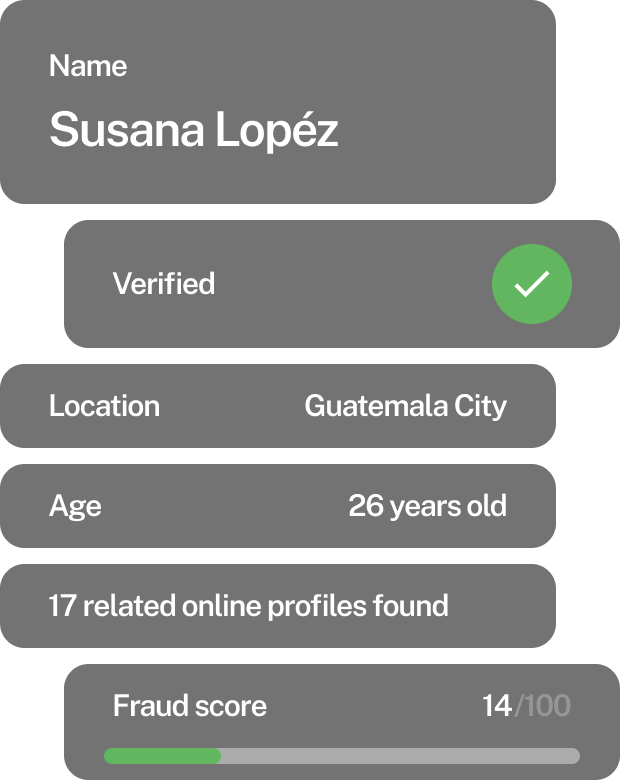

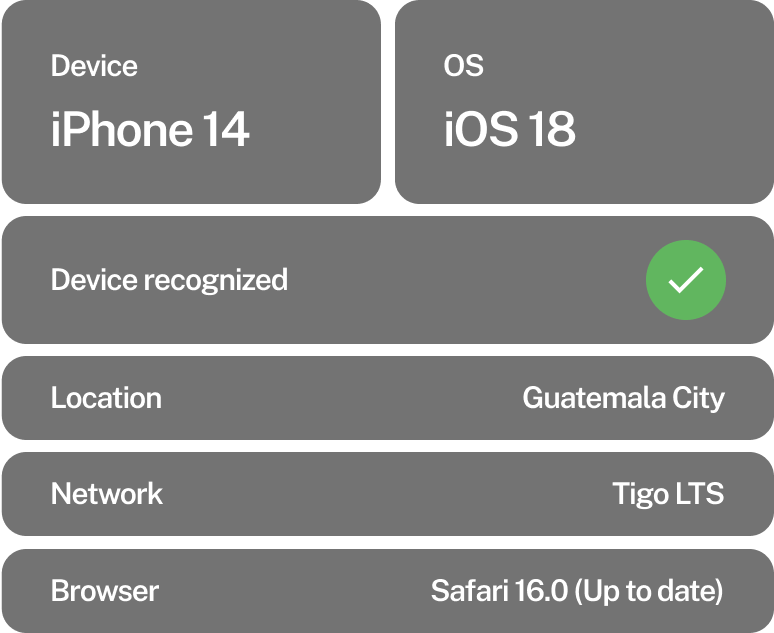

Device intelligence

Detect everything about your users devices

- Spot suspicious connections using geolocation, IP and behavioral biometrics like typing patterns and mouse movements to identify legitimate users and detect bots.

- Identify new and unrecognized devices by brand, OS, and browser version.

- Monitor on-call status, screen sharing and carriers to detect phishing and block coercion by spotting hesitations or unusual inputs linked to social engineering scams.

Stop fraud

Flag and block suspicious device activity

- Flag and block suspicious tools, setups and settings across desktop and mobile devices

- Identify high-risk browsers, privacy and location concealment tools such as Tor, Brave, Linken Sphere and GoLogin - to counter evasion tactics effectively.

- Detect complex device enviroments, including virtual machine enviroments, unusual browser activity and automation tools, to protet your business from sophisticated threats.

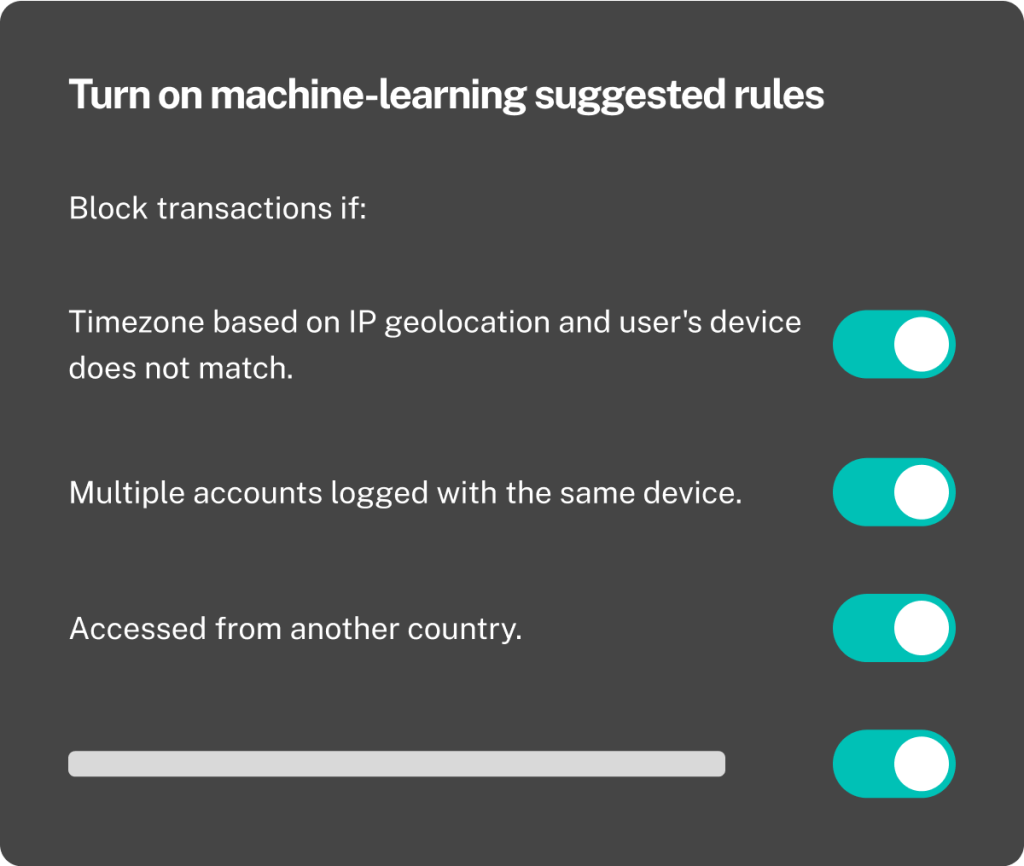

Device detection

Stay Ahead Of Emerging Threats

- Combine device data and other fraud signals to continuously improve detection accuracy.

- Fine-tune rules based on your cusmers' behavioral and device patterns and specific industry fraud vectors.

- Use AI to spot bot farms and frauds rings faster than the human eye using device and behavior signals.

Take the first step toward fraud prevention in your digital platform

Let’s connect to explore the possibilities and find the right solution that fits your business needs.

Fill out the form and one of our experts will be in touch.

You’ll learn how our solutions can specifically address your challenges, streamline your operations, and amplify your growth.

- Explore use cases for your industry

- Find the right solution for you

- Reduce fraud by 95%