Fintech

Secure digital finance and protect user transactions

SmartID’s solutions empower fintech companies to prevent fraud, secure transactions, and verify users without adding friction

Detect anomalies, protect customer accounts, and ensure compliance while delivering a seamless financial experience.

Emerging risks in fintech platforms

Identity Theft & Account Takeover (ATO)

Monitor login behaviors, detect credential stuffing attacks, and prevent unauthorized transactions.

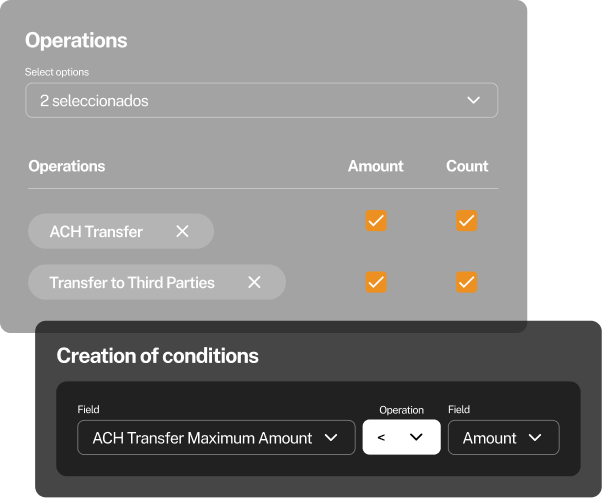

Transaction Fraud

Detect suspicious payment patterns, identify fraudulent transactions, and uncover synthetic identities.

Fraudulent Onboarding

Enhance identity verification using AI-powered document authentication and biometric validation.

Fraud is more sophisticated

Automated Financial Fraud

Identify AI-driven fraud by analyzing behavioral patterns, transactional anomalies, and device intelligence.

Social Engineering & Phishing Scams

Monitor user interactions for signs of coercion, hesitation, or fraudulent account modifications.

Payment Diversion & Account Manipulation

Prevent unauthorized financial activity using AI-powered risk detection and multi-layered verification.

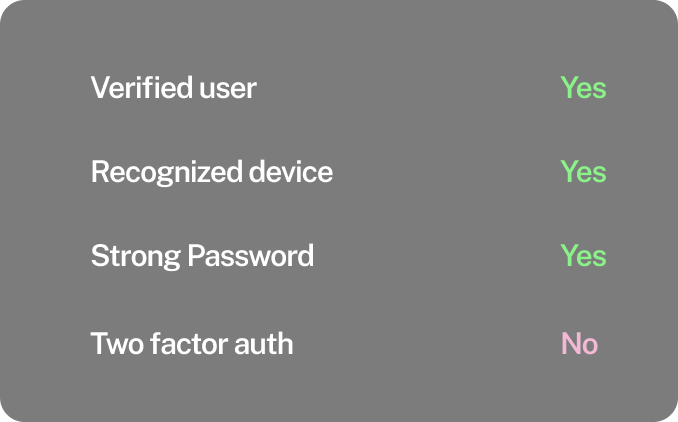

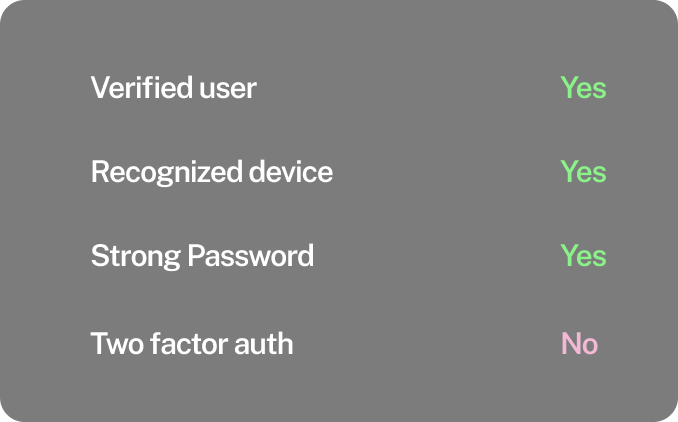

Smart Financial Authentication

Ensure secure transactions with adaptive authentication, including biometric verification, device recognition, and real-time risk scoring.

Device intelligence

Secure fintech transactions across all devices

- Identify and track devices used in fintech fraud, including high-risk IPs, emulators, and anonymization tools.

- Detect risky behaviors, such as rapid account logins, repeated failed authentication attempts, or irregular transaction patterns.

- Monitor device integrity to prevent manipulation via remote access tools and hidden automation scripts.

Prevent fraud before it happens

Detect and stop fraudulent financial activities in real time

- Flag unauthorized transactions from untrusted devices or high-risk geolocations.

- Identify accounts using privacy-enhancing tools like Tor, VPNs, or automation software.

- Detect anomalous transaction patterns and behavioral inconsistencies indicative of fraudulent activity.

Device detection

Fraud Prevention with AI-Powered Insights

- Leverage device intelligence and behavioral analytics to identify suspicious activities in real time.

- Continuously adapt fraud detection models based on transaction trends, user behavior, and evolving fintech threats

- Deploy AI-driven anomaly detection to uncover fraud networks, synthetic identities, and bot-driven attacks

Take the first step toward fraud prevention in your digital platform

Let’s connect to explore the possibilities and find the right solution that fits your business needs.

Fill out the form and one of our experts will be in touch.

You’ll learn how our solutions can specifically address your challenges, streamline your operations, and amplify your growth.

- Explore use cases for your industry

- Find the right solution for you

- Reduce fraud by 95%