Payment processing

Secure real payment transactions

SmartID’s solutions help payment processors, gateways, and fintechs secure every digital transaction while reducing fraud and friction.

Detect suspicious transactionals behaviors, and ensure secure payment experiences without compromising speed and convenience.

The evolving risks in digital payments

Transaction Fraud

Detect high-risk payments by analyzing user behavior, and transaction patterns.

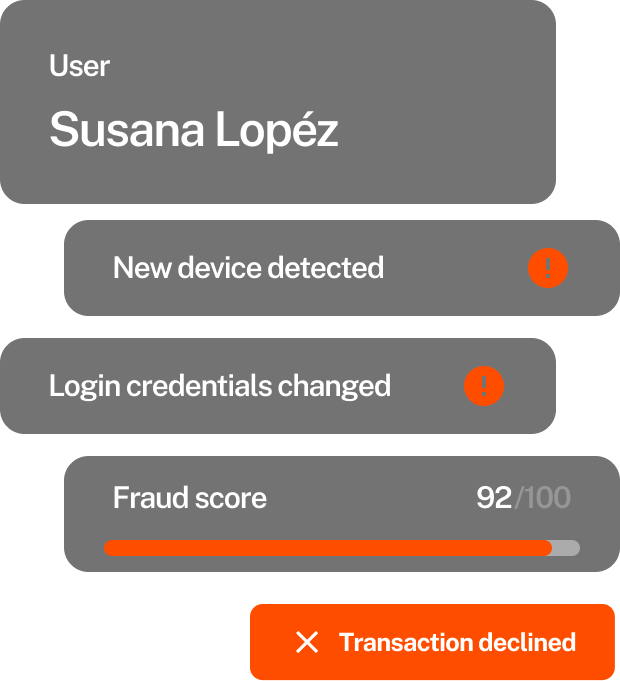

Account Takeover (ATO)

Monitor transactional behaviors, detect anomalies, and flag suspicious activity in real time.

Merchant Fraud

Identify unusual merchant behaviors, including transaction laundering and refund abuse.

Fraud is more sophisticated

Automated Payment Attacks

Detect unusual transaction volumes, repeated failed payment attempts, and rapid-fire transactions.

Stolen Credentials

Verify identities using AI-driven document authentication, biometrics, and behavioral analytics.

Scam Payments

Analyze interaction patterns to detect coercion, hesitation, or unusual payment behavior.

Multi-layered solution

Prevent unauthorized transactions with step-up authentication, behavioral biometrics, and AI-driven fraud detection.

Transactional intelligence

Secure every flow in the payment process

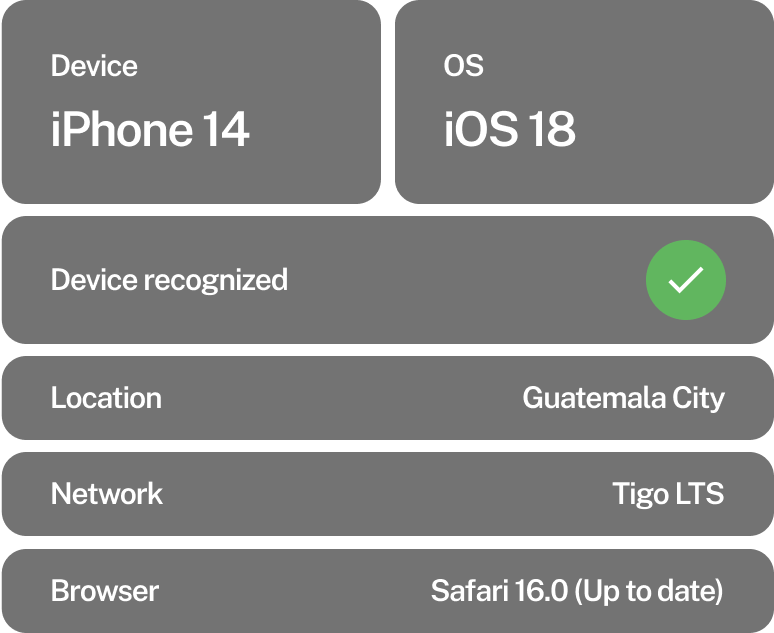

- Identify flow used for fraudulent transactions by analyzing geolocation, IP reputation, and behavioral signals.

- Recognize high-risk patterns used in fraudulent transactions.

- Strengthen payment security by detecting anomalies in real time, across all transaction channels.

Prevent payment fraud

Detect and stop fraudulent transactions in real time

- Flag payments from suspicious locations, or bot-driven behaviors.

- Identify transactions using obfuscation tools like Tor and VPNs to hide fraudulent activity.

- Detect evolving fraud tactics by continuously analyzing new payment risk patterns.

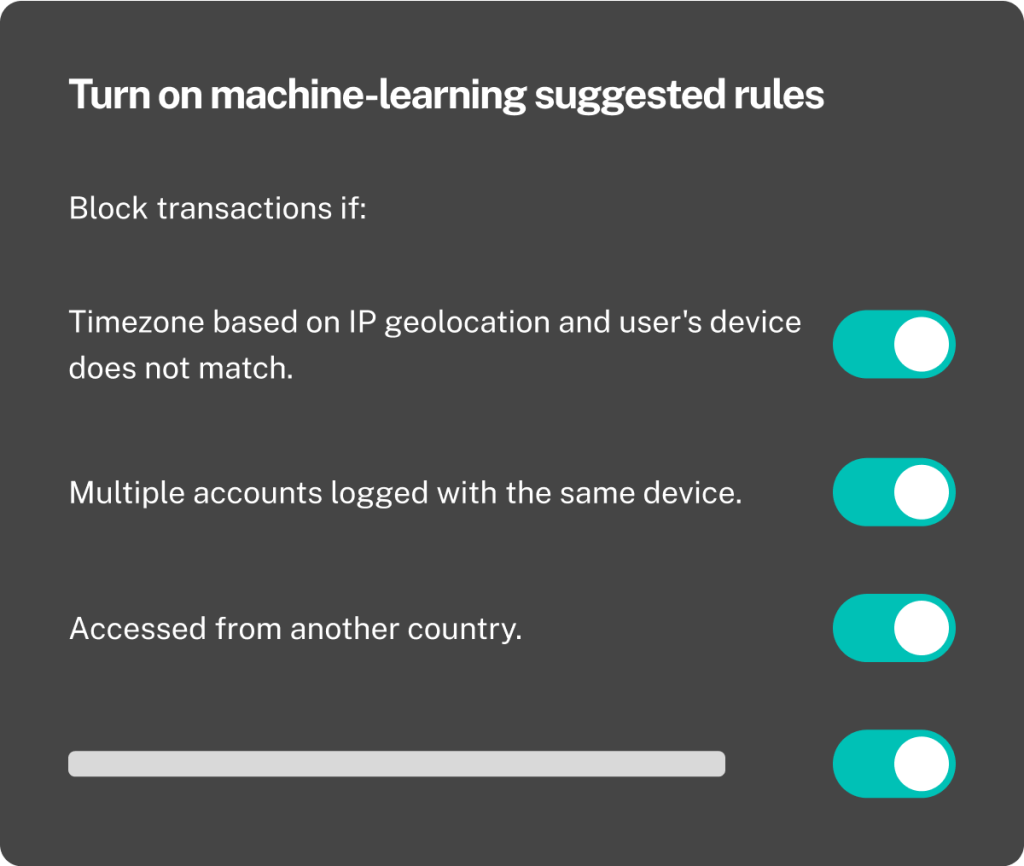

Adaptive fraud detection

Stay ahead of emerging payment fraud trends

- Continuously analyze transactional behaviors to detect emerging threats.

- Optimize fraud detection rules based on AI-driven insights and industry-specific payment risks.

- Leverage advanced machine learning to spot fraud faster than traditional systems.

Take the first step toward fraud prevention in your digital platform

Let’s connect to explore the possibilities and find the right solution that fits your business needs.

Fill out the form and one of our experts will be in touch.

You’ll learn how our solutions can specifically address your challenges, streamline your operations, and amplify your growth.

- Explore use cases for your industry

- Find the right solution for you

- Reduce fraud by 95%